The services of the Apple pay were first introduced in 2014. The service of the company has been gradually progressing towards international as well as domestic service. Recently few services for their mobile payment solution have been introduced by the company in their worldwide developer’s conference in 2016.

Brian Nichols from Investors Place points that Apple is only making 15 cents of money on each 100 dollars spent through their mobile payment service. The earning of the Apple is much lower than the companies like Mastercard and Visa. They make a share of 2 to 4 percent.

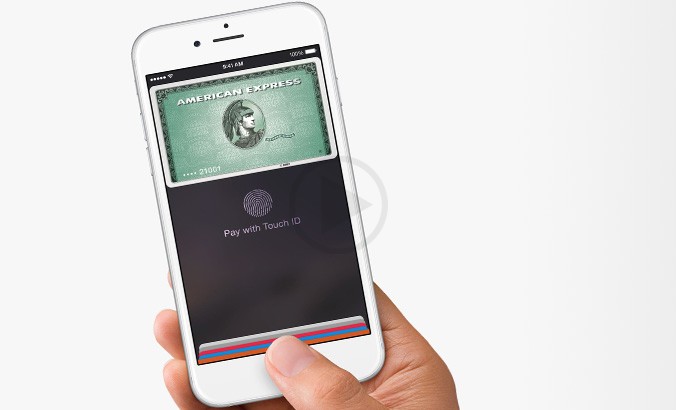

Nichols points and says that the acquisition of the American Express could be a very potential target for the company. American Express services are generally for the filthy rich people. The consumer of the American Express pays an annual fee for the service however Master and Visa card owners pay higher interest rates on the usage. American Express is worth 60 billion in the market. Apple can undoubtedly acquire American Express with their cash in hand however Apple won’t be doing it. If Apple were to absorb the business worth 30 billion dollars of the American Express then, Apple would spend their margin of 24 percent. American Express is an iconic brand carrying some of the biggest brand tie ups like Coca Cola, Walt Disney, Nike, etc.

According to the estimate of the Nichols Apple would be accountable for the estimated earnings of more than 750 million dollars as the Apple fees at the rate of 0.15 cents from every 100 dollars. At the rate of the Apple ‘earning, they will have to make transactions worth 60 trillion dollars to justify the acquisition. Looking at the stagnant growth of the company the plan of acquisition of the company looks dicey from the Apple’s end.