In June of a year ago, Apple Pay took off to an assortment of banks in the United Kingdom, with the prominent special case of Barclays. That left numerous people with iPhones, who need to utilize Apple Pay, out in the wind, sitting tight for the foundation to offer backing for the portable installment alternative. In January of this current year, the bank guaranteed that it would rollout support in late March, or at the most recent in April, however with no particular dates to hover on the schedule.

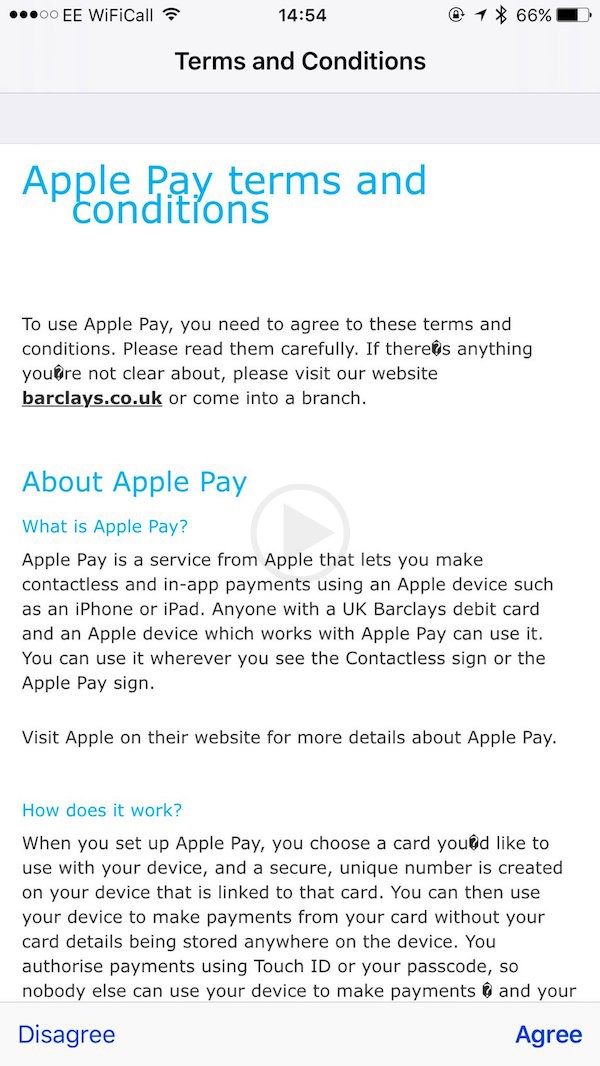

English bank Barclays has all the earmarks of being currently empowering highly foreseen Apple Pay support in the United Kingdom. This is mainly because some Twitter clients have shared screenshots of other terms and conditions page that now shows up when endeavoring to add a Barclays‐issued card to the iPhone‐based versatile installments administration.

The new terms and conditions point of arrival is an indication that Barclays might be very nearly at long last turning into an Apple Pay taking an interest guarantor, about nine months after the administration dispatched in the United Kingdom and inside of striking separation of its most recent guarantee of a late March rollout.

Barclays has over and again indicated that Apple Pay backing is coming, however, it has yet to convey on those arrangements. On July 2015, the bank said that Apple Pay backing was “fast approaching,” yet later affirmed a “mid 2016” target, and most as of late said the administration would dispatch “inside of 60 ‐ 75 days” of 12th January, or by around 28th March.

Barclays has been the biggest Apple Pay holdout in the U.K. to date. Other partaking banks incorporate First Direct, MBNA, HSBC, Nationwide, RBS, NatWest, Ulster Bank, Santander and the sky is the limit from there. Apple Watch as well as iPhone clients can tap to pay at more than 250,000 areas crosswise over Wales, England, Northern Ireland and Scotland.