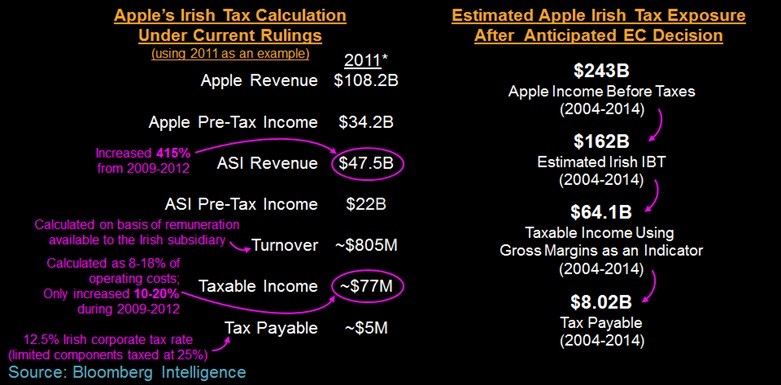

It has been rumored that Apple could owe more than $8 billion in back taxes if the European Commission finds something fishy with Apple’s corporate assessment practises in Ireland. Apple is one of the many MNCs that have been under the scanner for tax avoidance in the corporate category taxes of Ireland. The probes into the malpractice had been set up in June 2014. The report has accused the tech giant of having accepted bribes from the state of Ireland.

The organization’s $64.1 billion in profits obtained from the years 2004 to 2012, may be an that can be under the scanner for evading a 12.5% tax, this amount evaded could be exacted back from Apple. Apple supports many various backup and smaller companies in countries outside the US, these organizations then help reduce the tax which can be levied on foreign corporations and its operations in foreign companies. Apple has been repeatedly denying these allegations, but it is up to the European Commission to find wrongdoing and pass judgement on it.

A similar move was made by Apple in Italy, wherein the company had used a surrogate and small company from Ireland to operate in the country without much tax. The move was caughtby Italian courts and then the legitimate amount of tax was fined on Apple.